Insurance Policy Solutions Unveiled: Protect Your Future With Comprehensive Insurance Policy Providers

Our write-up, "Insurance coverage Solutions Unveiled: Secure Your Future With Comprehensive Insurance Coverage Services," will direct you via the ins and outs of insurance policy coverage. Discover the relevance of extensive policies, discover concerning various kinds of insurance, and gain useful pointers for choosing the best supplier. Don't miss out on out on optimizing your protection and browsing the insurance claims process with ease.

The Value of Comprehensive Insurance Policy Protection

You require to understand the importance of having comprehensive insurance policy protection for your future. Life is uncertain, and you never ever know what may take place. That's why it's important to have comprehensive insurance policy that can safeguard you from various threats and uncertainties.

Comprehensive insurance protection supplies you with a vast array of protection. It not only covers problems to your building but also safeguards you monetarily in situation of accidents, burglary, or all-natural calamities. With detailed coverage, you can have assurance recognizing that you are financially secure also in the worst-case situations.

Among the essential advantages of comprehensive insurance is that it covers damages to your vehicle created by mishaps, criminal damage, or fire. Rather than fretting regarding the costs of fixing or replacing your automobile, extensive insurance coverage guarantees that you are secured economically.

Additionally, comprehensive insurance likewise covers theft-related events - Home Insurance Eden Prairie. If your cars and truck obtains stolen or any kind of important products are swiped from it, thorough protection will certainly make up for the loss, minimizing the monetary concern on you

Moreover, extensive insurance safeguards your home or residential property from damages caused by natural catastrophes like floods, earthquakes, or typhoons. This coverage guarantees that you can recoup and rebuild without dealing with substantial economic problems.

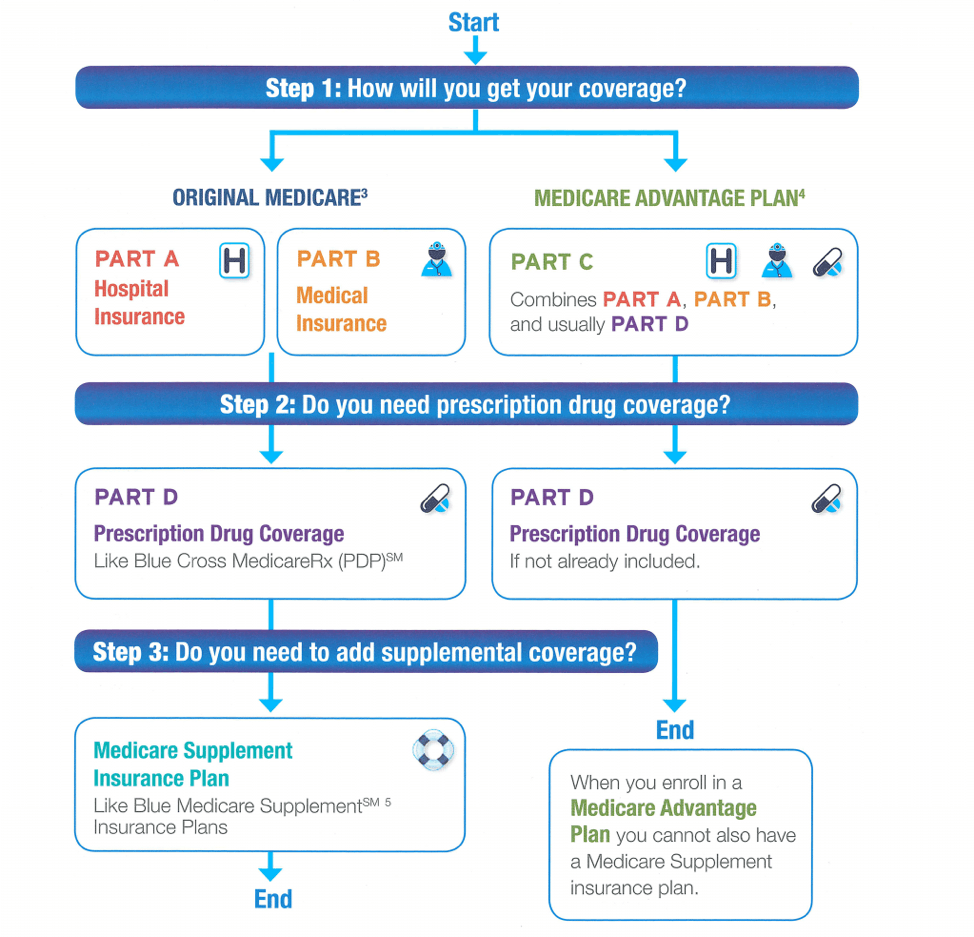

Understanding the Various Sorts Of Insurance Plan

One usual kind of insurance policy is auto insurance policy, which supplies insurance coverage for injuries and damages resulting from automobile mishaps. One more vital kind of insurance policy is wellness insurance, which covers clinical costs and provides access to healthcare services. Home owners insurance is an additional type of insurance policy that safeguards your residential property and personal belongings versus damages or theft.

## Variables to Take Into Consideration When Selecting an Insurance Provider

When taking into consideration an insurance coverage supplier, it is essential to investigate their online reputation and consumer evaluations. When you require them the a lot of, you desire to guarantee that you pick a reliable and dependable firm that will be there for you. Start by seeking out on-line evaluations and ratings from other insurance holders. These testimonials can provide you important insights right into the carrier's customer care, asserts process, and general fulfillment. Additionally, check if the insurance policy service provider has actually been certified by reliable companies or if they have actually won any type of sector awards. This can be a great indication of their expertise and devotion to serving their clients. An additional aspect to consider is the series of insurance products offered by the company. You want to ensure that they provide the details coverage you require, whether it's auto, home, life, or wellness insurance coverage. Take a look at the provider's financial stability. You intend to select a business that has a strong monetary standing and has the ability to accomplish their responsibilities in case of a claim. By extensively researching and considering these elements, you can make an informed decision and select the appropriate insurance coverage company for your needs.

Tips for Maximizing Your Insurance Coverage

One method to obtain the most out of your insurance coverage is by regularly assessing and updating your plan. Insurance needs can change with time, so it is essential to ensure that your insurance coverage straightens with your current circumstance. Start by examining the coverage limits and deductibles on your policy. Are they still appropriate for your requirements? Think about any major life click to investigate adjustments that might have taken place because you last reviewed your policy, such as marrying, having kids, or buying a brand-new home. These adjustments may require changes to your protection to adequately secure your assets and enjoyed ones.

It's also vital to examine the sorts of coverage consisted of in your policy. Are you sufficiently covered for prospective risks and responsibilities? If you possess an organization, you might require added protection for specialist responsibility or cyber responsibility. If you possess important properties, such as fashion jewelry or artwork, you may need to include a biker to your plan to guarantee they are adequately covered in the occasion of loss or damages.

One more important facet of maximizing your insurance policy protection is understanding the exclusions and constraints of your plan. Take the time to go through your policy papers and ask your insurance coverage provider any concerns you might have. Knowing what is covered and what is not can aid you make informed choices concerning your insurance coverage.

Last but not least, consider looking around for insurance quotes periodically. Insurance prices can vary among carriers, so it's worth contrasting rates to ensure you are getting the very best offer for the insurance coverage you need. Keep in mind that the most inexpensive choice might not always be the most effective, so take into her comment is here consideration variables such as client solution, claims process, and economic stability when selecting an insurance coverage company.

:max_bytes(150000):strip_icc()/Primary-Image-best-restaurant-insurance-companies-of-december-2022-6944509-e9da2932f6c541bd8fa9636c141a2c5f.jpg)

Navigating the Claims Process: What You Need to Know

To navigate the insurance claims process smoothly, see to it you understand the steps involved and collect all the needed paperwork. Contact your insurance coverage service provider as quickly as possible after the occurrence takes place. They will lead you via the procedure and clarify what you require to do following. Be prepared to provide detailed details concerning the event, consisting of the day, time, area, and any other relevant details. It is essential to collect all the required documents to sustain your claim. This may include photos of the damages, cops reports, medical documents, and any type of various other proof that can validate your insurance claim. Bear in mind that your insurance policy provider may need you to complete specific forms or provide additional details. Be certain to follow their instructions carefully to avoid any type of hold-ups in the cases procedure. Don't think twice to get to out to your insurance provider for aid if you have any kind of inquiries or concerns along the means. They exist to assist you browse the insurance claims process and make sure that you receive the protection you're entitled to.

Conclusion

So there you have it, a comprehensive overview to safeguarding your future with insurance policy options. Now that you recognize the significance of comprehensive coverage and the different kinds of policies offered, it's time to choose the read this post here ideal insurance supplier for you. Remember to take into consideration aspects like credibility, customer care, and cost. And when you have your plan in position, don't fail to remember to maximize your coverage by examining it consistently and making any type of required adjustments. Finally, if you ever before require to make an insurance claim, make sure to browse the process with confidence, recognizing what to expect. With the appropriate insurance solutions, you can have peace of mind understanding that you are safeguarded for whatever the future might hold.